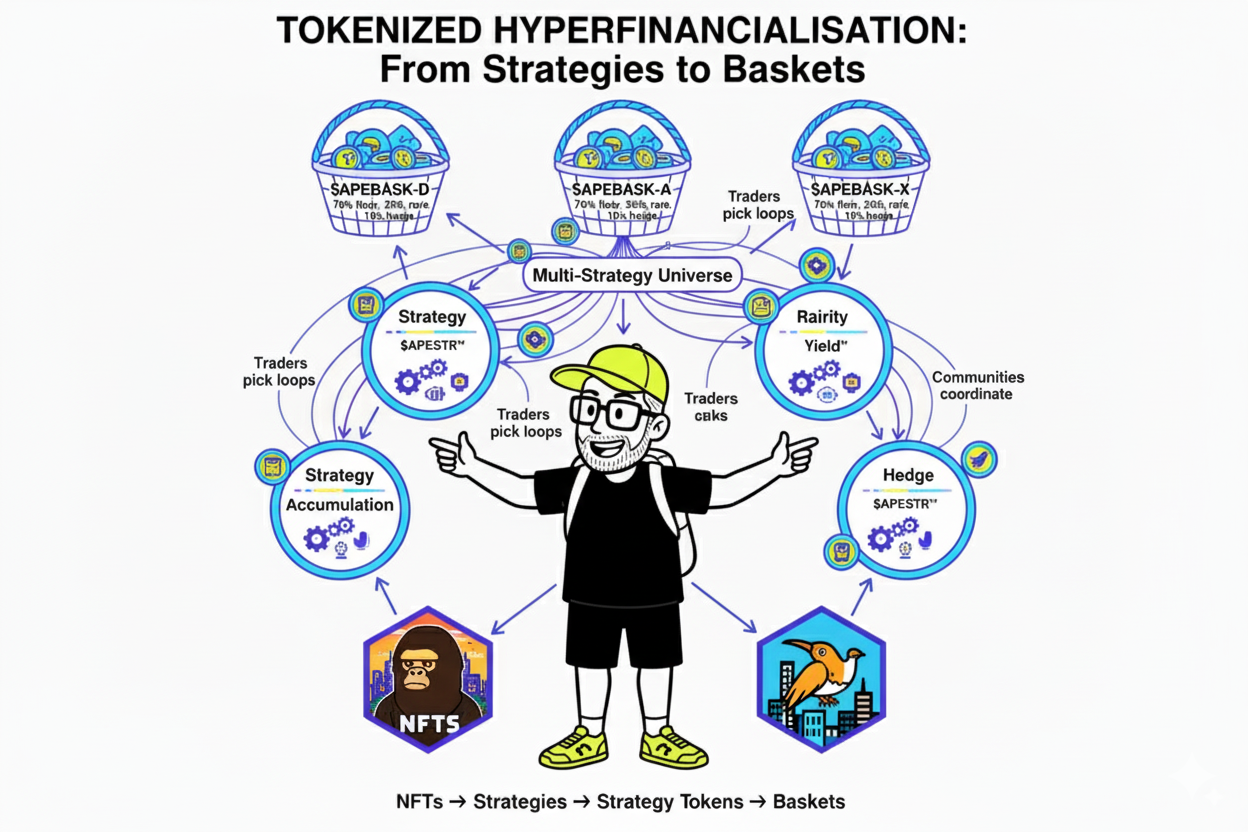

1. The Core: NFTs as Financial Building Blocks

TradFi built finance around bundles: ETFs, funds, indexes. In Web3, we unbundle down to the root — the NFT collection itself.

- Each NFT collection becomes a financial primitive.

- Each primitive can host multiple perpetual strategies.

An NFT is no longer just art or membership. It is the anchor for financial engines.

2. Strategies: Perpetual Machines With Their Own Tickers

Every strategy is tokenized, tradable, and perpetual:

- Floor Accumulation Strategy: buys the floor and relists higher.

- Rarity Strategy: targets rare traits.

- Yield Strategy: farms yield, recycles it back.

- Hedge Strategy: balances downside risk.

Each strategy spawns its own token ($APESTR, $APESTR-RARE, $APESTR-YLD, $APESTR-HEDGE).

These are financial Lego blocks, orbiting the NFT collection and feeding value back into it.

3. Hyperfinancialisation: The Multi-Strategy Universe

When every collection spawns not one but many strategy tokens, we get a market of markets.

- Traders pick which loop they believe in.

- Communities coordinate around different sub-ecosystems.

- Developers compose strategies like code functions.

This is tokenized hyperfinancialisation: every cultural asset is surrounded by multiple, parallel financial flywheels.

4. Baskets: The Meta-Layer of Finance

The next frontier is token baskets:

- A basket is a new token that holds a weighted mix of strategies.

- Allocations define different risk/reward profiles.

- Defensive, balanced, or aggressive — all engineered on-chain.

Examples:

- $APEBASK-D → 70% floor, 20% rare, 10% hedge.

- $APEBASK-A → 40% rare, 40% yield, 20% hedge.

- $APEBASK-X → 60% yield, 30% leverage, 10% hedge.

Baskets themselves can be recombined into cross-collection indexes. The system becomes fractal:

NFTs → Strategies → Strategy Tokens → Baskets → Basket Tokens.

5. Why This Matters

Tokenized hyperfinancialisation is the maximum density of finance:

- Every cultural unit spawns financial engines.

- Every engine has a ticker, a loop, and a market.

- Every set of strategies can be recombined into baskets.

This is finance without intermediaries, culture without limits, and perpetual value machines running on-chain.

It’s not just speculation — it’s the architecture of infinite composability, where every NFT collection becomes a financial operating system.