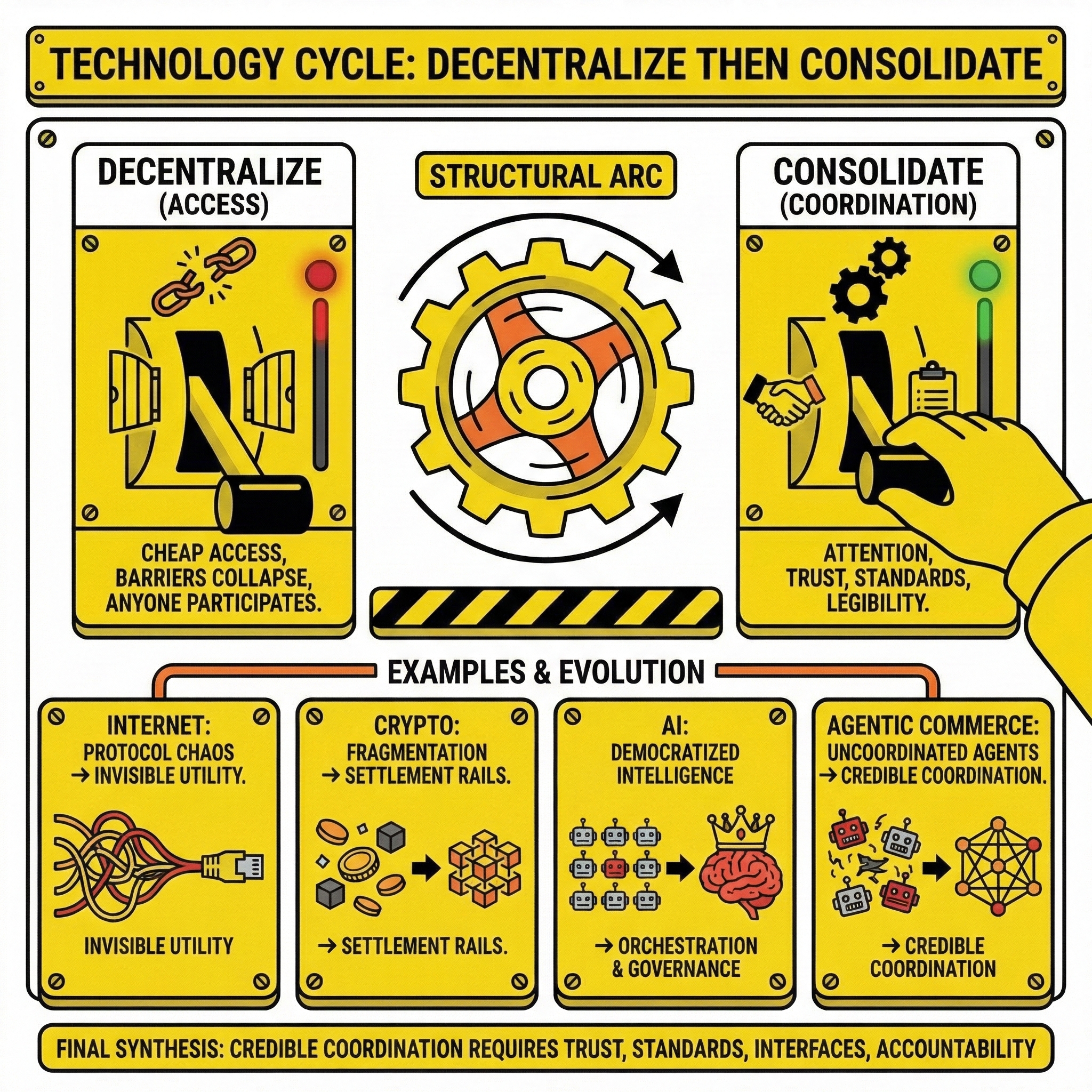

Why New Technologies Decentralize First — and Consolidate Later

Every major technology shift follows the same structural arc.

At the beginning, power decentralizes.

Access becomes cheap.

Barriers collapse.

Anyone can participate.

Then something breaks.

Not the technology — the coordination layer.

When everyone can build, publish, deploy, or transact, the problem is no longer capability.

The problem becomes attention, trust, and decision-making.

This is the moment most people misread as failure.

In reality, it is the start of consolidation.

Decentralization removes gatekeepers.

It does not remove gravity.

Markets always converge around:

- reliability

- liquidity

- standards

- legibility

- coordination

This pattern has already played out.

Multiple times.

Example 1: The Internet — From Protocol Chaos to Invisible Utility

The early internet was radically decentralized.

Between the 1970s and early 1990s, dozens of networking protocols competed. None were dominant. Anyone could run a server. Anyone could publish. Innovation was everywhere.

Then the web exploded.

By the late 1990s, millions of websites existed, discovery collapsed, and attention fragmented. The dot-com boom wasn’t a triumph of business models — it was a symptom of coordination failure.

The crash in 2000–2002 did not kill the internet.

It selected it.

TCP/IP and HTTP survived.

Everything else became irrelevant.

After that, power shifted upward:

- browsers abstracted protocols

- search engines mediated attention

- platforms coordinated users and developers

The internet didn’t recentralize at the protocol layer.

It recentralized at the coordination layer.

By the 2010s, the internet was no longer visible.

It had become infrastructure.

Example 2: Crypto — Decentralized Settlement, Centralized Gravity

Crypto repeated the same mistake — and learned the same lesson.

Early crypto was defined by fragmentation:

- countless chains

- incompatible standards

- ideological maximalism

- narrative overload

This was necessary exploration.

But decentralization of access produced a new bottleneck: liquidity and trust.

After the 2022–2023 collapse, something became clear:

- capital concentrates faster than ideology adapts

- developers follow liquidity

- institutions require legible rails

Today, crypto is still decentralized — but only where it matters:

- settlement

- ownership

- censorship resistance

At the coordination level, convergence is already happening:

- a small number of execution and settlement rails dominate

- wallets, custody, and infrastructure providers form platform layers

- applications are increasingly replaceable

Crypto did not escape power laws.

It delayed them.

Example 3: AI — Intelligence Is Decentralized, Authority Is Not

AI feels new, but structurally it is already mid-cycle.

The initial breakthrough democratized intelligence.

Models became accessible. APIs spread. Anyone could build.

Then attention collapsed.

Thousands of tools, copilots, wrappers, and demos competed for relevance. The question stopped being “can it do this?” and became “which one do I trust?”

We are now watching AI consolidate around:

- a small number of foundation models

- standardized inference pipelines

- cost, latency, and reliability constraints

Intelligence is becoming cheap.

Judgment is not.

The real power in AI is shifting away from raw capability and toward:

- orchestration

- governance

- decision authority

This is the same move the internet made after the protocol wars — and the same move crypto is making now.

Example 4: Agentic Commerce — Early, Noisy, Uncoordinated

Agentic commerce is earlier on the curve — but the pattern is already visible.

Today’s agent ecosystem looks like:

- thousands of agents

- incompatible frameworks

- unclear trust boundaries

- no shared economic coordination

The problem is not intelligence.

Agents can already act.

The problem is who authorizes them, who audits them, and who absorbs the risk when they act incorrectly.

This is not a model problem.

It is a coordination problem.

And coordination always recentralizes.

Agentic commerce will not be won by the smartest agent.

It will be won by whoever controls:

- execution standards

- trust layers

- economic settlement

- enforcement and rollback

Exactly like every cycle before it.

The Uncomfortable Truth

Decentralization happens first at access.

It happens last at power.

Every cycle looks revolutionary at the edges and conservative at the center.

What changes is not the pattern — only the surface technology.

Those who mistake early fragmentation for long-term structure build the wrong things.

Those who understand the cycle build rails, not noise.

The Final Synthesis

- The internet solved information distribution

- Crypto solves value settlement

- AI solves cognition

- Agentic commerce must solve coordinated action

And coordinated action always requires:

- trust

- standards

- interfaces

- accountability

The future does not belong to maximal decentralization.

It belongs to credible coordination.

Not louder systems.

Not smarter systems.

Systems people are willing to rely on.

| Phase | Internet (Years) | Crypto | AI (General) | Agentic Commerce | What This Phase Is Really About |

|---|---|---|---|---|---|

| Phase 1: Raw Capability Breakthrough | 1975–1990 | 2009–2016 | 2012–2018 | 2022–2023 | New capability exists, no coordination |

| Phase 2: Open Access Explosion | 1990–1995 | 2016–2019 | 2019–2022 | 2023–2024 | Everyone can build, no standards |

| Phase 3: Attention Flood | 1995–1999 | 2020–2021 | 2022–2023 | 2024 | Too many demos, tools, promises |

| Phase 4: Crash & Reality Check | 2000–2002 | 2022–2023 | 2024 (ongoing) | Upcoming | Hype collapses, constraints surface |

| Phase 5: Rail Convergence | 2002–2006 | 2023–2025 (now) | 2024–2026 | Emerging | Few primitives start to dominate |

| Phase 6: Platform Formation | 2006–2010 | Next 1–3 yrs | Next 1–2 yrs | Next | Control shifts to orchestration |

| Phase 7: Institutionalization | 2010–2015 | Emerging | Future | Future | Regulation + reliability |

| Phase 8: Invisible Utility | 2015+ | Future | Future | Future | Becomes boring infrastructure |