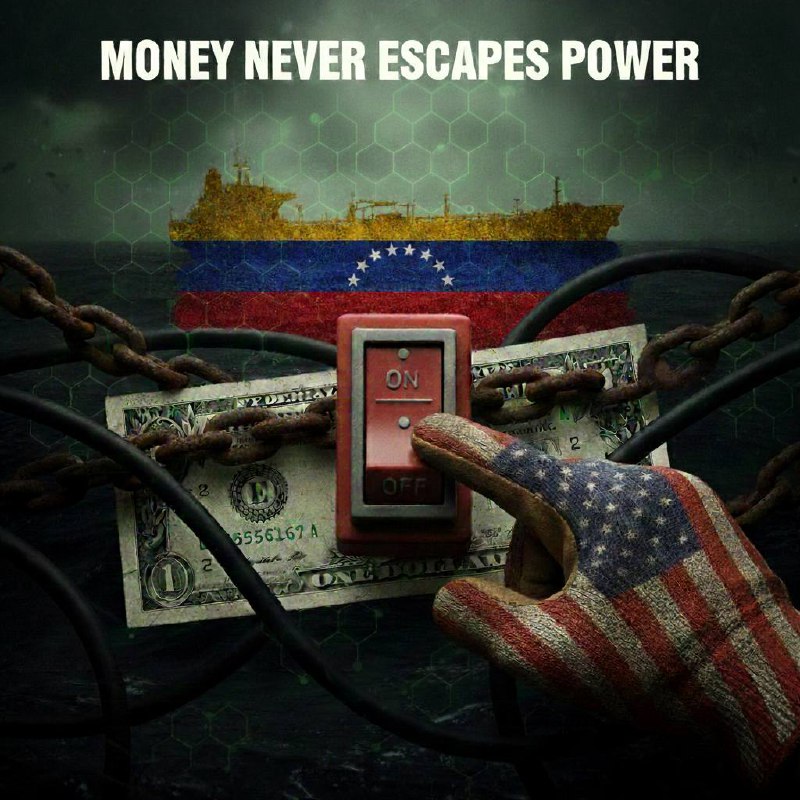

USDT, Venezuela, and the Return of Permission

Everyone knew.

That’s the part people now pretend to forget.

Everyone knew USDT wasn’t decentralized.

Everyone knew it could be frozen.

Everyone knew it answered to an issuer, jurisdictions, and pressure.

And still, for years, none of that seemed to matter.

Because USDT worked.

It stayed liquid when banks failed.

It moved when wires were blocked.

It scaled when alternatives fractured.

It became something far more dangerous than a stablecoin:

infrastructure.

WHEN THE DOLLAR PUT ON A BLOCKCHAIN MASK

Sanctions don’t stop flows.

They reroute them.

When Venezuela’s access to the traditional financial system tightened, oil didn’t stop moving. Payments didn’t disappear. The system adapted.

Settlement shifted into USDT.

Primarily on Tron.

Fast, cheap, deep liquidity.

This wasn’t ideology.

It was logistics.

For the state, USDT became a workaround.

For citizens, a survival tool.

For traders, a spread.

And for the crypto ecosystem, something else entirely:

Proof that stablecoins had crossed a line.

They were no longer financial products.

They were geopolitical rails.

THE ILLUSION OF NEUTRALITY

The core mistake wasn’t technical.

It was psychological.

Markets began treating USDT like electricity — always on, politically invisible, neutral by default.

But money doesn’t work that way.

It never has.

The moment USDT touched:

- commodities

- sanctions

- sovereign revenue

it stopped being “just a stablecoin”.

It became a choke point.

And choke points are where power accumulates.

PERMISSION NEVER DISAPPEARED — IT WAS DELAYED

USDT didn’t fail.

The peg held.

Liquidity held.

Blocks kept producing.

What failed was the assumption that scale equals sovereignty.

USDT was never permissionless.

It was permissive — temporarily.

And when enforcement pressure arrived, permission snapped back into place instantly.

Addresses frozen.

Flows interrupted.

Counterparties exposed.

Not because something broke —

but because control was always there.

STABLECOINS ARE NOT APOLITICAL

THEY ARE PRE-POLITICAL

This is the part that still makes people uncomfortable.

USDT isn’t a scam.

It isn’t broken.

It isn’t “evil”.

It is something more revealing.

Stablecoins sit in an unstable middle layer:

- more scalable than banks

- more controllable than cash

- less sovereign than fiat

- less free than crypto

They absorb political pressure rather than resist it.

That’s why they work.

And that’s why they fail exactly when they matter most.

THE REAL RISK WAS NEVER THE PEG

Crypto culture obsesses over the wrong failure modes.

Everyone watches for:

- depegs

- liquidity cliffs

- bank runs

But the real risk is quieter:

Assuming adoption equals immunity.

USDT scaled faster than regulatory clarity.

That created dependency.

Dependency created leverage.

Not for users.

For issuers and states.

WHAT THIS ACTUALLY MEANS FOR CRYPTO

This episode doesn’t kill stablecoins.

It matures them.

What emerges next is fragmentation, not collapse:

- “Clean” stablecoins for regulated capital

- “Grey” rails for frontier and sanctioned markets

- Volatile assets for those who want real sovereignty

Bitcoin survives by being hard to govern.

Stablecoins survive by being easy to regulate.

They solve different problems.

At different layers.

With different costs.

The mistake was pretending otherwise.

THE PREDATOR’S LAW

USDT didn’t betray anyone.

It reminded the market of a rule older than crypto, older than banks, older than oil:

Money never escapes power.

It only reveals who holds it.

And if your system was built on the fantasy that scale alone creates freedom?

You weren’t early.

You were exposed.