Europe didn’t shoot itself in the head.

It chose something colder.

It chose control over speed.

Process over power.

Rules over reach.

And like every system that optimizes for safety first, it has quietly optimized innovation out of its own borders.

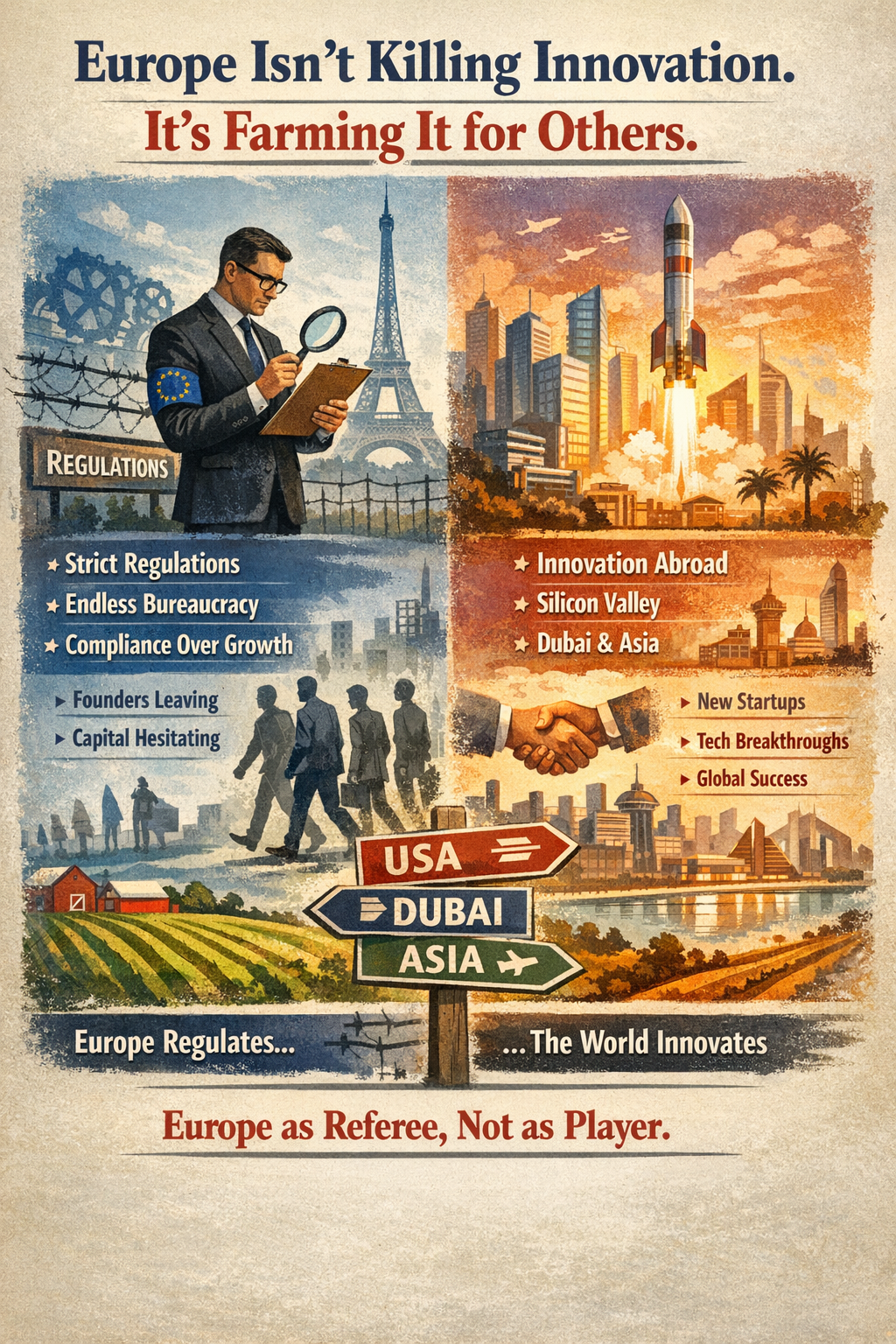

Regulation as ideology

European regulation is often framed as protection.

Consumer protection. Market protection. Democratic protection.

That framing is incomplete.

What Europe actually protects is institutional continuity.

Banks must survive.

States must collect.

Systems must remain legible to auditors, not founders.

MiCA, DAC8, CARF, GDPR — these are not random acts of bureaucracy. They are expressions of a worldview:

Nothing should exist that cannot be measured, supervised, and reconciled.

That worldview works exceptionally well for mature systems.

It is hostile to emergent ones.

The fatal timing error

Europe’s core mistake is not regulation itself.

It is when regulation happens.

Europe regulates before scale.

The US regulates after dominance.

China regulates during consolidation.

This timing difference is everything.

By regulating before product–market fit, Europe forces innovation to justify itself to a system that does not yet understand what it is regulating. The result is predictable:

- founders leave

- capital hesitates

- experimentation moves elsewhere

Europe becomes a standards body for technologies built abroad.

The illusion of neutrality

European policymakers often believe regulation is neutral.

It is not.

Regulation is an economic weapon — just not one Europe wields offensively.

Heavy compliance burdens do not kill markets. They select for incumbents.

Large institutions absorb compliance as overhead.

Small teams experience it as existential risk.

The effect is silent but brutal:

- fewer startups

- fewer experiments

- fewer asymmetric outcomes

The ecosystem becomes legible, stable — and strategically irrelevant.

Europe as referee, not player

Europe is not trying to win the game.

It is trying to officiate it.

This makes Europe indispensable — but never dominant.

Like GDPR, Europe will export its rules globally. Others will comply. Many will complain. Some will copy. But none will build their most dangerous ideas inside the rulebook.

Innovation will happen:

- in the US (speed + capital)

- in the UAE (regulatory arbitrage)

- in Asia (scale + execution)

Europe will then:

- certify it

- regulate it

- tax it

- institutionalize it

This is not collapse.

It is managed irrelevance.

The predatorial truth

Predators do not ask permission to evolve.

They move first.

They adapt in the open.

They accept chaos as the price of dominance.

Europe despises chaos.

So it will never produce the next Google, OpenAI, Binance, or Nvidia from scratch again.

But it will regulate them better than anyone else.

That is the trade.

What founders already know

Smart founders have adjusted.

They don’t fight Europe.

They route around it.

They build where speed is allowed.

They incorporate where capital flows.

They return to Europe when regulation becomes an asset instead of a shackle.

Europe becomes the finishing layer — not the ignition.

Final thought

Europe is not dying.

It is aging.

And aging systems do not hunt.

They manage the ecosystem left behind.

Whether that is wisdom or surrender depends on one thing only:

Do you want to build the future —

or audit it once it arrives?