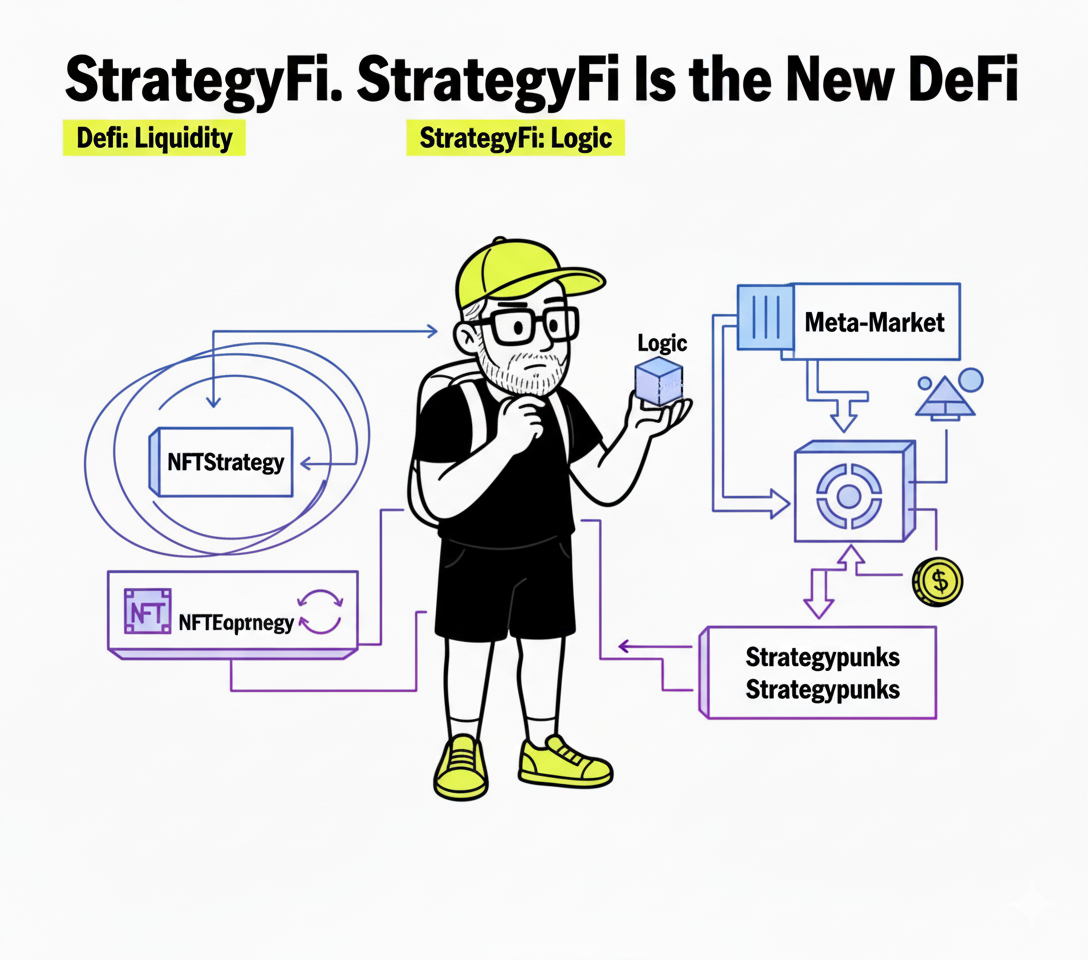

DeFi was about liquidity.

StrategyFi is about logic.

In DeFi, we farmed yield from capital.

In StrategyFi, we farm yield from behavior.

What started as JPEGs on blockchains has now become programmable market intelligence — tokenized, recursive, and composable.

1. From Yield Farming to Strategy Farming

DeFi abstracted banking.

It replaced intermediaries with contracts and turned liquidity into a programmable commodity.

The result was yield farming — capital generating capital through loops of incentive.

StrategyFi abstracts trading itself.

It replaces human execution with tokenized behavior — automated, self-reinforcing strategies that trade markets on behalf of holders.

It’s not “put your money to work.”

It’s put your logic to work.

2. NFTStrategy: The Behavioral Primitive

NFTStrategy marks the first real use case of StrategyFi.

It turned speculation into a machine — a self-contained loop that automatically buys floor NFTs, relists them, and compounds profits through its own token economy.

The NFT becomes a component, not the product.

The strategy — the behavior encoded in the loop — becomes the asset.

Participants don’t buy art; they buy execution.

They don’t own a picture; they own the function that moves it.

That’s the birth of tokenized behavior — the first layer of StrategyFi.

3. Strategypunks: The MicroStrategy of the Loop

Then came Strategypunks.

It doesn’t run multiple strategies.

It doesn’t diversify risk.

It simply accumulates $PUNKSTR, the strategy token tied to PunkStrategy.

That makes it the MicroStrategy (MSTR) of StrategyFi — a conviction vehicle that tokenizes belief in one base strategy, just as MSTR tokenized belief in Bitcoin.

Strategypunks doesn’t innovate through new mechanics.

It innovates through reflexivity: it turns conviction itself into a tradable asset.

The loop buys the strategy token; the strategy token benefits from visibility; visibility attracts liquidity; liquidity reinforces the loop.

Belief becomes structure.

4. The Stack of StrategyFi

The system is now visibly forming:

| Layer | Function | Analogy | Example |

|---|---|---|---|

| 1. Primitives | NFTs as raw material for financial logic. | Bitcoin / Assets | Punks, Apes |

| 2. Strategy Tokens | Tokenized trading behaviors. | DeFi protocols | NFTStrategy / PunkStrategy |

| 3. Conviction Vehicles | Treasury entities accumulating strategy tokens. | MicroStrategy ($MSTR) | Strategypunks |

| 4. Baskets / Indexes | Aggregated exposure across strategies. | ETFs / Yield Aggregators | (Emerging soon) |

| 5. Reflexive Ecosystem | Strategies that invest in other strategies. | Recursive DeFi | (Inevitable) |

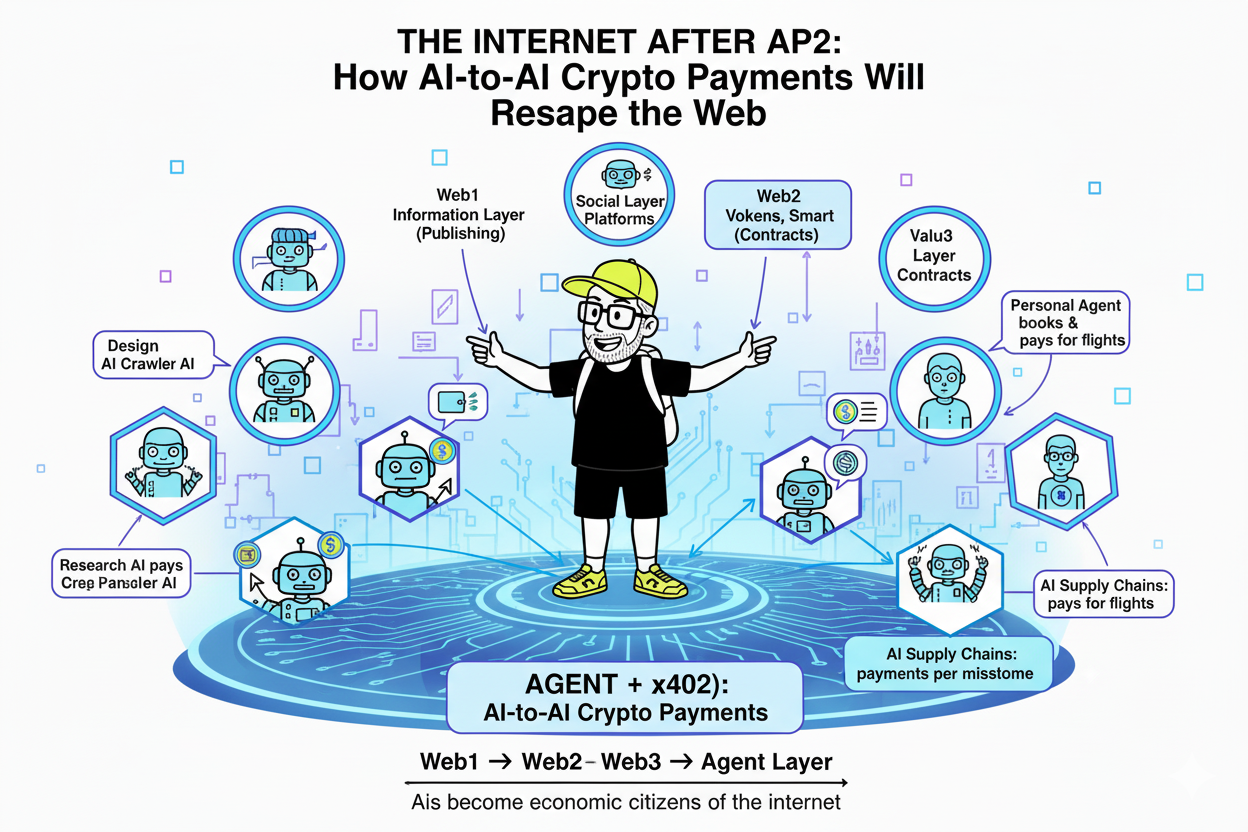

DeFi had composability of contracts.

StrategyFi introduces composability of strategies themselves.

5. Strategy as an Asset Class

The core paradigm shift is this:

Strategy becomes the asset.

Not the token, not the liquidity pool — but the executable market logic.

Just as DeFi democratized liquidity provisioning, StrategyFi democratizes execution.

Anyone can own part of a strategy.

Anyone can hold conviction in how markets behave.

That’s an entirely new layer of capital formation — where the thing being traded is how trading happens.

6. The Reflexive Future

In DeFi, liquidity loops created reflexivity.

In StrategyFi, recursive strategies will do the same.

Strategy tokens will buy into other strategies.

Conviction vehicles will accumulate baskets of loops.

Indexes will tokenize cross-strategy exposure.

Eventually, autonomous portfolios will self-compose — and the line between market participant and market structure will blur completely.

The market will stop trading assets.

It will start trading behaviors.

7. From Protocols to Personalities

DeFi protocols were infrastructure.

StrategyFi entities will be actors.

Each strategy behaves like a financial organism — with conviction, feedback, and identity.

Strategypunks is the first one with a visible personality: a treasury that believes, accumulates, and performs.

As more of these conviction vehicles emerge, the system starts to look alive — a jungle of recursive capital organisms competing, mirroring, and evolving.

8. The DeFi–to–StrategyFi Transition

DeFi unlocked programmable liquidity.

StrategyFi unlocks programmable conviction.

DeFi built markets.

StrategyFi builds meta-markets — markets of strategies trading each other.

If DeFi was the industrialization of finance,

StrategyFi is its autonomization.

The loop no longer needs you to click.

It loops itself.

That’s StrategyFi.

And it’s the new DeFi.